Yes. When creditors obtain a judgment for an unpaid debt, they can docket that judgment to create a lien against your real property. This is entirely different from a mortgage lien, which is voluntarily agreed to in a contract with a bank.

Two common questions I hear are:

- Can a debt collector put a lien on my home?

- How long does that lien last?

For these answers, we look to New York CPLR § 5203 [Priorities and liens upon Real Property]. This section represents the third entry in my blog series that seeks to summarize all 53 sections of New York's Statutory Code "Enforcement of Money Judgments."

A money judgment—even one arising from a small credit card debt—can result in a lien on your home and any other real property.

"Docketing" of Judgment Creates the Lien

A money judgment becomes a lien on the judgment debtor's real property. It secures a priority for the judgment creditor when the judgment is "docketed"[1] with the county clerk of the county in which the real property is located. Docketing creates a lien.

To constitute the docketing of a judgment to create a judgment lien in New York, the process involves filing a Transcript of Judgment with the County Clerk's Office. This transcript is requested from the City Court Clerk and filed with the County Clerk for an additional cost. Once filed, the judgment becomes a lien on any land owned or acquired by the debtor in the county, affecting their ability to sell or obtain credit.

The Lien is Effective for 10 Years

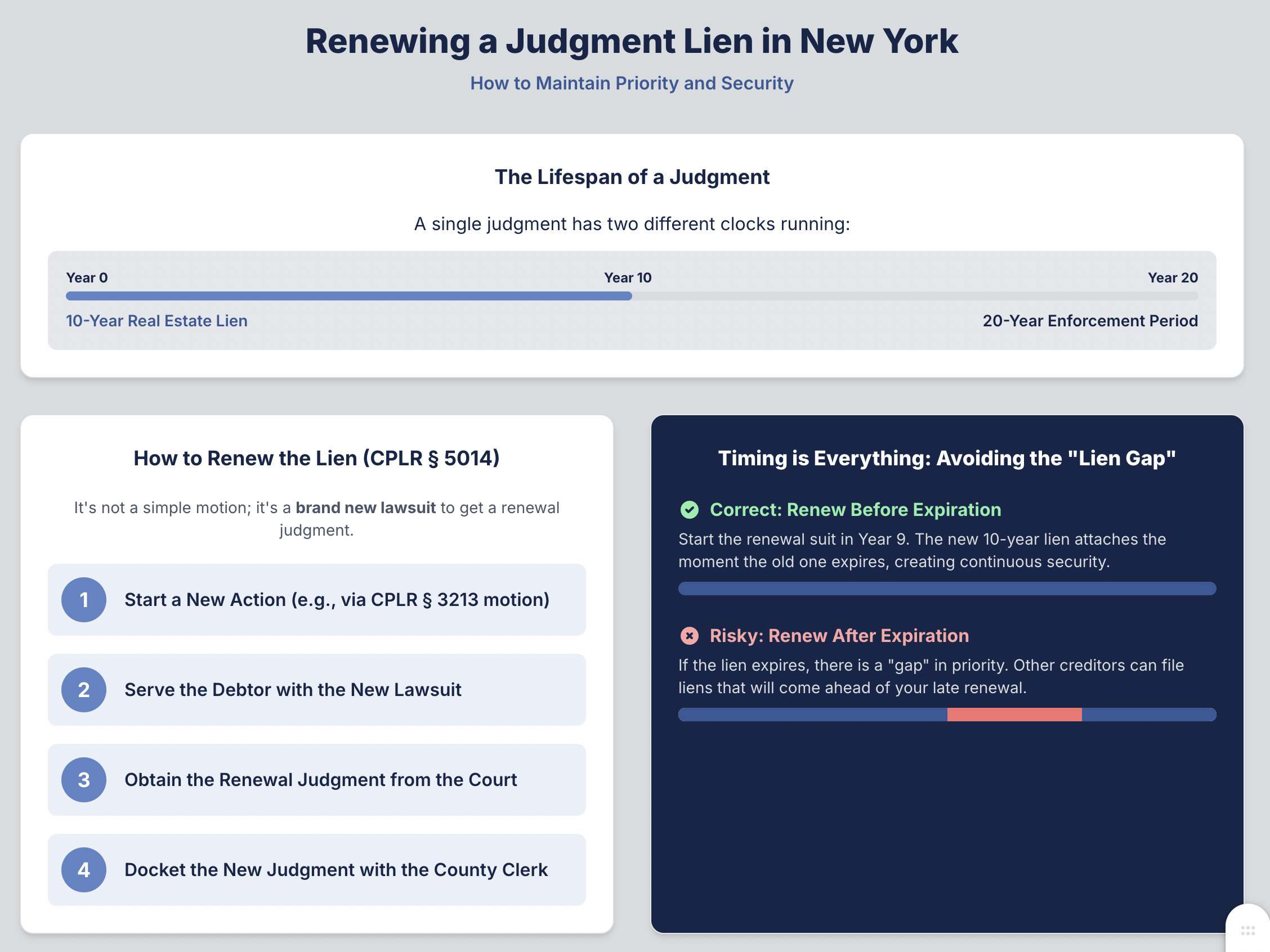

The lien attaches once the judgment is docketed, and it remains effective until 10 years after the judgment-roll was filed (CPLR 5203 [a]). If docketing lags behind the filing, the lien’s life is correspondingly shorter. A judgment creditor can renew[2] that lien but must do so before the expiration of the 10 years.[3] Best practice is to start the § 5014 renewal suit in the final year before the lien expires, which avoids a ‘lien gap’; if you file later you may still obtain a renewal judgment, but the real-property lien will lapse during the gap.

If the debtor owns property in a different county, a Transcript of Judgment can also be obtained and filed in that county.

How the Homestead Exemption Works in New York

If you need help, share your case details.

Renewing Judgment Liens in New York

- A properly docketed judgment creates a 10-year lien on real property and is enforceable for 20 years. CPLR 5014 permits a creditor to obtain a renewal judgment—which restarts a 20-year enforcement period and a new 10-year real-property lien—each time the prior lien is about to expire; the statute does not limit the number of renewals.

- A renewal judgment is obtained by starting a new action under CPLR 5014 (often expedited with a CPLR 3213 motion for summary judgment in lieu of complaint), serving the debtor, and obtaining judgment; it is not merely a post-judgment motion..

- Failing to renew a judgment lien does not invalidate the judgment but means the lien no longer effectively "secures" the judgment, and the creditor cannot foreclose on the property if the debtor does not pay the debt.

CPLR 5203: Priority and Lien of Money Judgments on NY Real Property

- In New York, a money judgment creates a lien on the judgment debtor's real property from the time the judgment is docketed with the county clerk. The lien remains effective for ten years, subject to certain exceptions.

- The court may extend the lien's effectiveness beyond ten years if the judgment creditor was stayed from enforcing the judgment or if additional time is necessary to complete the sale of real property under an execution delivered to a sheriff before the expiration of the ten years.

- A judgment effectuating a court's determination of real property ownership is deemed entered and docketed on the day preceding the determination date for establishing priority against a simultaneous or later bankruptcy petition, provided the judgment is docketed within thirty days of the determination.

Docketing Judgments and Renewal Liens: Two New York Cases

To create a lien on real property, a money judgment must be properly docketed with the county clerk where the property is located, under the correct surname of the judgment debtor (Kunin v. Guttman, 181 A.D.3d 880 [2d Dept. 2020]; Fischer v. Chabbot, 178 A.D.3d 923 [2d Dept. 2019]). Under CPLR 5014 the lien of a renewal judgment takes effect retroactively at the moment the original lien expired—ten years after the first docketing—so any delay between expiry and new docketing leaves a gap in lien priority.

Banks, debt buyers, and collection lawyers seek your money and property to satisfy their default judgments. First, they may seek to restrain ("freeze") your bank accounts. Next in line is the wage garnishment if they can find where you're employed. Depending on their collection strategy and the size of the judgment, they may seek to attach a lien on your home.

Here is a brief description of how debt collectors obtain their judgment in a lower civil court and then transcribe the judgment in the Supreme Court to obtain the lien on your home.

The above applies to New York only.

If you need help, share your case details.

[1] “Docketing” is distinct from both “entry” of the judgment and “filing of the judgment-roll,” though in Supreme and County Courts these steps usually happen at the same time.

Entry occurs when the clerk signs and files the judgment, making it an official court determination.

Filing the judgment-roll refers to assembling and filing the complete record of the case that led to the judgment, including pleadings, motions, and the judgment itself. This filing formally closes the record.

Docketing happens when the clerk records the key details of the judgment in the county’s judgment docket (an alphabetical index of judgments). Under CPLR 5018(c), this entry includes the names of the parties, the amount, and the date. Only upon docketing does the judgment become a lien on any real property the debtor owns in that county. (See CPLR 5203; CPLR 5018(c).)

[2] CPLR § 5014.

[3] The 10 years begins to run from the filing of the judgment roll, which happens before docketing and can happen in a lower court (not Supreme Court or County Court).