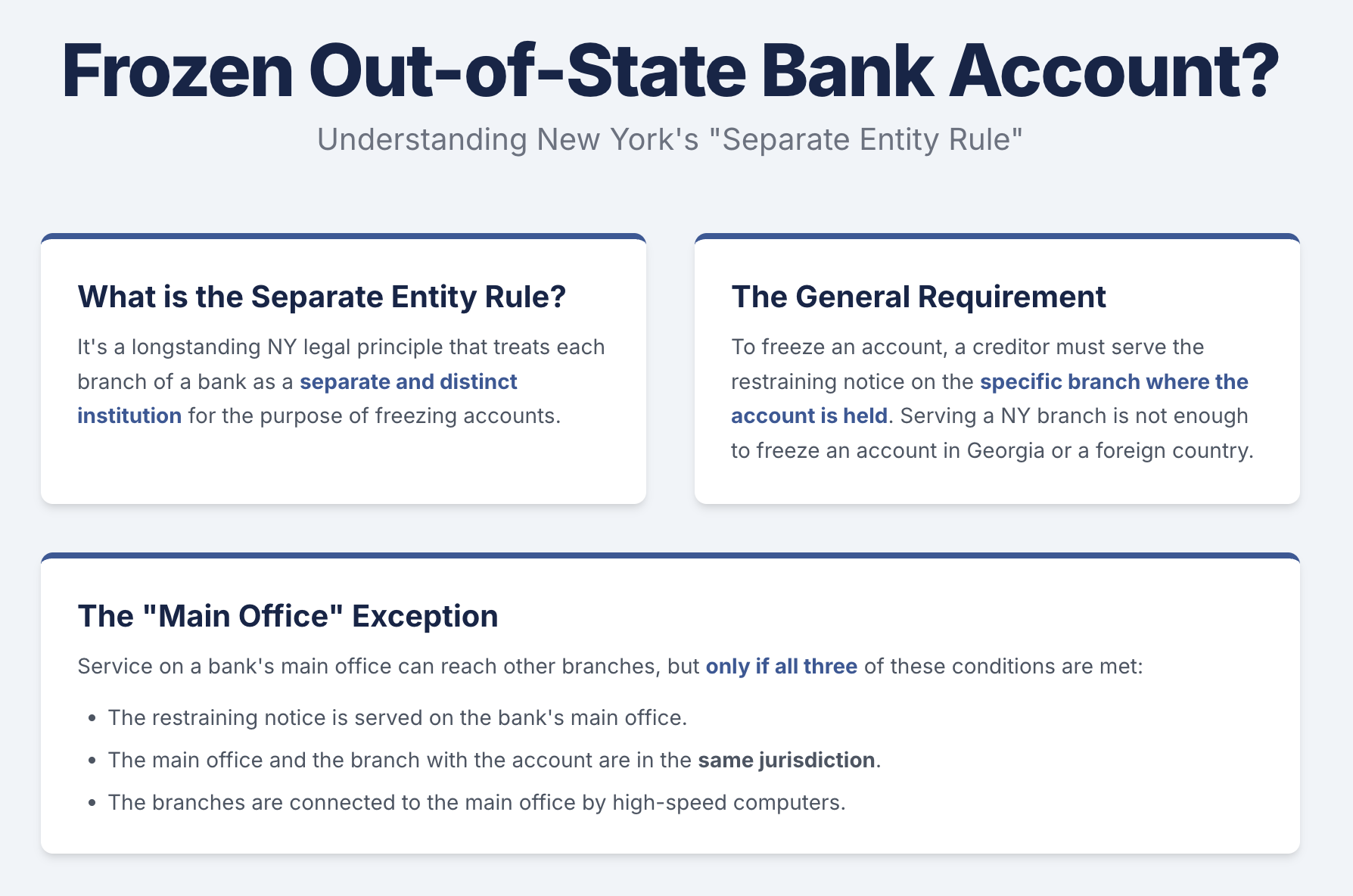

Many out-of-state clients panic upon discovering their bank accounts frozen due to a New York default judgment. Is this legal? The cases below, including those of New York's highest court, affirm the "Separate Entity Rule," which you will learn about below.

Many out-of-state clients panic upon discovering their bank accounts frozen due to a New York default judgment. Is this legal? The cases below, including those of New York's highest court, affirm the "Separate Entity Rule," which you will learn about below.

Lawyers for New York judgment creditors often freeze debtor bank accounts located out of state. Some assumed Koehler v. Bank of Bermuda (2009) eliminated the Separate Entity Rule. It did not; the Court of Appeals in Motorola (2014) reaffirmed the rule for foreign branches.. These lawyers presumed Koehler[1] overruled New York's separate entity rule, which considers bank branches as distinct institutions. However, a recent case indicates this assumption was incorrect.

New York's Highest Court Reaffirms Separate Entity Rule for International Banking

The New York Court of Appeals upheld the state's "separate entity rule," determining that serving a restraining notice on a bank's New York branch does not effectively freeze assets held in the bank's overseas branches. This ruling came in a case where a judgment creditor attempted to restrain funds held in foreign branches of a bank with New York operations.

Key Legal Principles:

- Under the separate entity rule, different branches of a bank are treated as distinct entities for specific legal purposes, such as restraining notices and turnover orders.

- For foreign branches, service on a NY branch does not reach assets abroad. For domestic branches, service is typically required at the account‑holding branch, unless the main‑office/same‑jurisdiction exception applies.

- The rule serves to maintain international comity and shield banks from conflicting claims and potential double liability.

Conclusion: The Court's decision maintains the longstanding separate entity rule, deeming it still applicable in modern international banking despite technological progress. This ruling effectively prevents judgment creditors from using a bank's New York presence to freeze assets held in its foreign branches.

Citation: Motorola Credit Corp. v Standard Chartered Bank, 24 NY3d 149 (2014).

The Separate Entity Rule Reaffirmed: A Victory for Consumers

In Lease Finance Group, LLC v. Fiske,[2] salvation comes to consumers and the collection-defense bar.

In Frske, the collectors served a restraining notice on a Wells Fargo branch in Pennsylvania while the debtor lived in Georgia. The judgment was entered in New York.

Relying on a New York Appeals case,[3] Judge d’Auguste applied National Union and related cases, requiring service at the Georgia branch holding the account (no exception applied).

There is an exception to the separate entity rule "due to the advent of high-speed computers and sophisticated communications equipment" such that "service of a restraining order upon a bank's main branch is adequate." The exception is limited to the following circumstances:

- The restraining notice is served on the bank's main office;

- The main office and the branches where the accounts in question are maintained are within the same jurisdiction; and

- The bank branches are connected to the main office by high-speed computers and are under centralized control.

Applied here, Georgia is not in the same jurisdiction as Pennsylvania, so the separate entity rule exception does not apply. Because Wells Fargo’s Georgia branch wasn’t served, the restraint was ineffective as to the Georgia account.

The court noted that New York's highest court recently affirmed the separate entity rule as applied to bank accounts in foreign countries (see that blog here: Creditors May Not Seize Foreign Bank Account Through U.S. Branches). However, that case did not address the issue concerning domestic bank branches.

Judge d'Auguste found controlling precedential value in Nat'l Union Fire Ins. (footnote 2) and applied the separate entity rule to domestic bank branches.

How Creditor Restraining Notices Freeze Bank Accounts

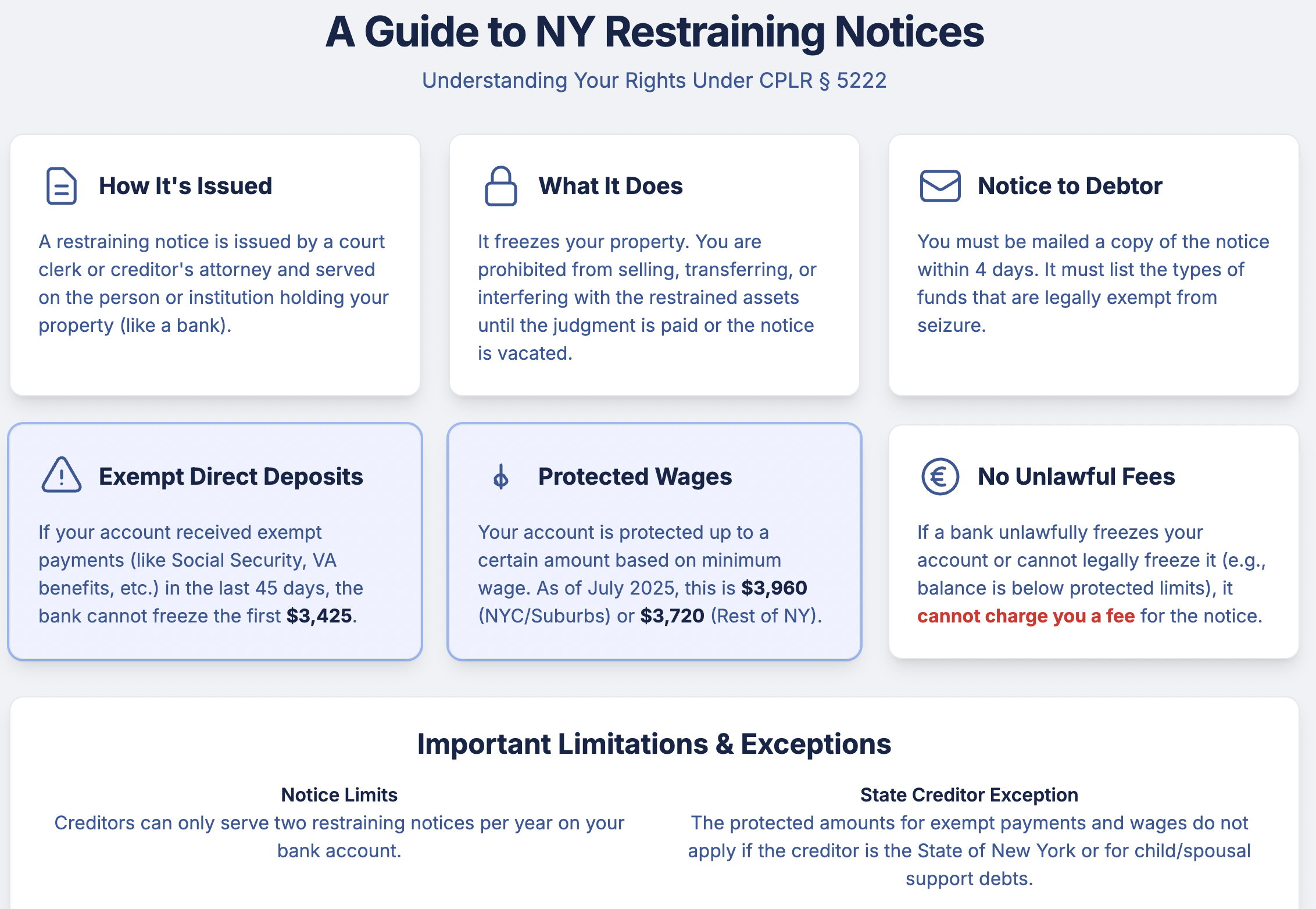

A restraining notice in the context of consumer bank accounts is a legal mechanism creditors use to temporarily freeze or "restrain" a debtor's bank account. It's typically used after a judgment has been made in favor of the creditor, allowing them to secure funds from the debtor's account to satisfy the debt.

The restraining notice is served on the bank, and the creditor must send the Notice to Judgment Debtor within 4 days (unless 5222‑a applies). Except where CPLR § 5222‑a applies, if the statutory notice in subdivision (e) has not been given within one year before service of a restraining notice, a copy of the restraining notice together with the Notice to Judgment Debtor or Obligor shall be mailed by first‑class mail or personally delivered to each judgment debtor/obligor who is a natural person within four (4) days after service of the restraining notice. The notice shall be sent to the debtor’s residence; if returned as undeliverable or the residence is unknown, it shall be sent to the debtor’s place of employment (if known) in an envelope marked ‘personal and confidential’ with no indication on the outside that the communication is from an attorney or concerns a judgment; if neither is known, it shall be sent to any other known address..

For example, under the New York Civil Practice Law and Rules (CPLR) Section 5222, certain funds, including a minimum balance or funds derived from specific sources like Social Security or disability payments, cannot be restrained. This protection ensures the consumer can still meet essential financial obligations despite the debt recovery process. Consumers need to understand these rights and potentially seek legal counsel if a restraining notice is issued against their bank account.

Summary of CPLR § 5222. Restraining Notice

The below summary of CPLR § 5222 provides a concise and easy-to-understand overview of the actual statute, composed of legal terminology and statutory language that can often be difficult to decipher for those without a legal background.

CPLR § 5222 governs the issuance and service of restraining notices and the specifics regarding the implications for judgment debtors and those who hold the debtor's property.

(a) Restraining Notice Issuance and Service: A restraining notice intended to freeze a bank account is issued by the court clerk, the creditor's attorney, or the support collection unit. This notice is served to anyone except the debtor's employer when the property is wages or salary. Serve personally or by registered/certified mail (regular mail only if issued by the support collection unit); electronic service requires written consent under 5222(g). It includes details of the judgment or order and a warning about potential contempt of court penalties for non-compliance. An amended notice is issued if there's an interest rate change during a restraint.

(b) Effect of Restraint and Duration: Upon receiving the notice, a debtor is prohibited from transferring or interfering with any property they own, unless directed by the court or sheriff, until the debt is settled or the order vacated. Any property or debt in the debtor's possession becomes subject to the notice. Those who are not the debtor but are served with the notice should not transfer or dispose of any property or money involved until the judgment is satisfied, vacated, or one-year passes.

(c) Subsequent Notice: A court's permission is required to serve more than one restraining notice on the same person for the same judgment. A creditor cannot serve more than two notices per year on a natural person's bank account. If the interest rate changes during a restraint, an amended notice is issued without court permission.

(d) Notice to Judgment Debtor or Obligor: If the debtor hasn't received a notice within a year before the restraining notice, a copy of the restraining notice, along with the notice to the debtor, should be mailed to them within four days of the service of the restraining notice.

(e) Content of Notice: The notice to the debtor should inform them that their money or property may have been taken or held to satisfy a judgment and provide a list of money or property types exempt from being taken to satisfy judgments.

(f) Definition of "Order": An "order" in this context refers to a directive from a competent court requiring payment of support, alimony, or maintenance upon which a "default" has been established.

(g) Electronic Restraining Notice: With written consent, a restraining notice can be served in an electronic format, such as magnetic tape. However, notice to the debtor must still be given in written form.

(h) Effect on Accounts Receiving Exempt Payments: IIf direct deposit or other electronic payments reasonably identifiable as statutorily exempt were made to the debtor’s account within the 45 days before service, the bank shall not restrain $3,425; if the account balance is $3,425 or less, the account shall not be restrained and the restraining notice is deemed void (CPLR § 5222(h)).

(i) Effect on Debtor's Banking Account: A restraining notice should not apply to amounts equal to or less than 240 times the federal or state minimum hourly wage, whichever is greater unless a court determines the amount is not necessary for the debtor's reasonable requirements. As of July 2025, the CPLR § 5222(i) wage‑based floors are $3,960 (with a 90% “void” level of $3,564) in NYC, Nassau, Suffolk, and Westchester and $3,720 (90%: $3,348) in the rest of New York; separately, CPLR § 5222(h) protects $3,425 where exempt deposits posted within 45 days (for cases commenced on/after Apr 1, 2024).

(j) Bank Fees for Processing Restraining Notice: If a bank served with a restraining notice cannot lawfully freeze a debtor's account, or a freeze is imposed in violation of any section of this chapter, the bank may not charge the debtor any fee.

(k) State of New York as Creditor Exceptions: The provisions in sections (h), (i), and (j) don't apply when the creditor is the state of New York, its agencies, or municipal corporations, or if the debt being enforced is for child support, spousal support, maintenance or alimony. These exceptions should be clearly stated in the restraining notice. Friends, if your bank account(s) have been frozen, call us immediately for a consultation.

Friends, if your bank account(s) have been frozen, call us immediately for a consultation.

If you need help, complete this intake form.