What is a Blanket Security Agreement?

A blanket security agreement is a contract between a borrower and a lender that grants the lender a security interest in multiple assets or all assets of the borrower's business. It serves as collateral for a loan, providing the lender with rights to seize these assets if the borrower defaults. They typically do not include real estate, which is governed by separate laws and requires different documentation (like mortgages or deeds of trust).

Key Points to Understand:

- Scope of Security Agreements: Security agreements generally cover personal property or business assets used as collateral. They typically do not include real estate, which is governed by separate laws and requires different documentation.

- Business vs. Personal Assets: A blanket security agreement for business assets usually covers items like inventory, equipment, and accounts receivable. Personal residences are typically considered separate from business assets.

- UCC Article 9 and Its Limitations: Law: UCC Article 9 governs these personal‑property liens; it does not cover real estate.

- Requirements for Including Real Estate: Real estate requires a separate document (mortgage/deed of trust) signed specifically for that property.

- The Role of Personal Guarantees: AYou become personally liable. Your home isn’t liened automatically, but a later court judgment could reach it.

Real-World Example: Imagine a small business owner, Sarah, who owns a bakery. She seeks a loan to expand her operations. The lender offers financing with a blanket security agreement covering her business assets, including kitchen equipment, inventory, and accounts receivable.

![]()

What's the Difference Between a Security Agreement and a Financing Statement?

Security Agreement (Private Contract)

- What it is: The actual contract between borrower and lender that creates the security interest.

- Example language: "Borrower grants Lender a security interest in: (a) all inventory, including raw materials, work in process, and finished goods; (b) all equipment, including machinery, vehicles, and computer hardware; (c) all accounts receivable and payment intangibles; and (d) all proceeds of the foregoing."

- Remedy if too generic: If the description is too vague, the lender may not have a valid lien—good for the debtor, but disputes can arise.

Financing Statement (Public Notice - UCC-1)

- What it is: A public filing that perfects the security interest and warns other creditors.

- Example language: "All assets of the debtor, whether now owned or hereafter acquired, including all personal property and proceeds thereof." OR simply: "All assets."

- Remedy if too generic: None needed - supergeneric descriptions are explicitly permitted by UCC § 9-504 for financing statements.

- Why the Difference? The contract defines exactly what the lender can claim. The public filing just warns others to ask for details

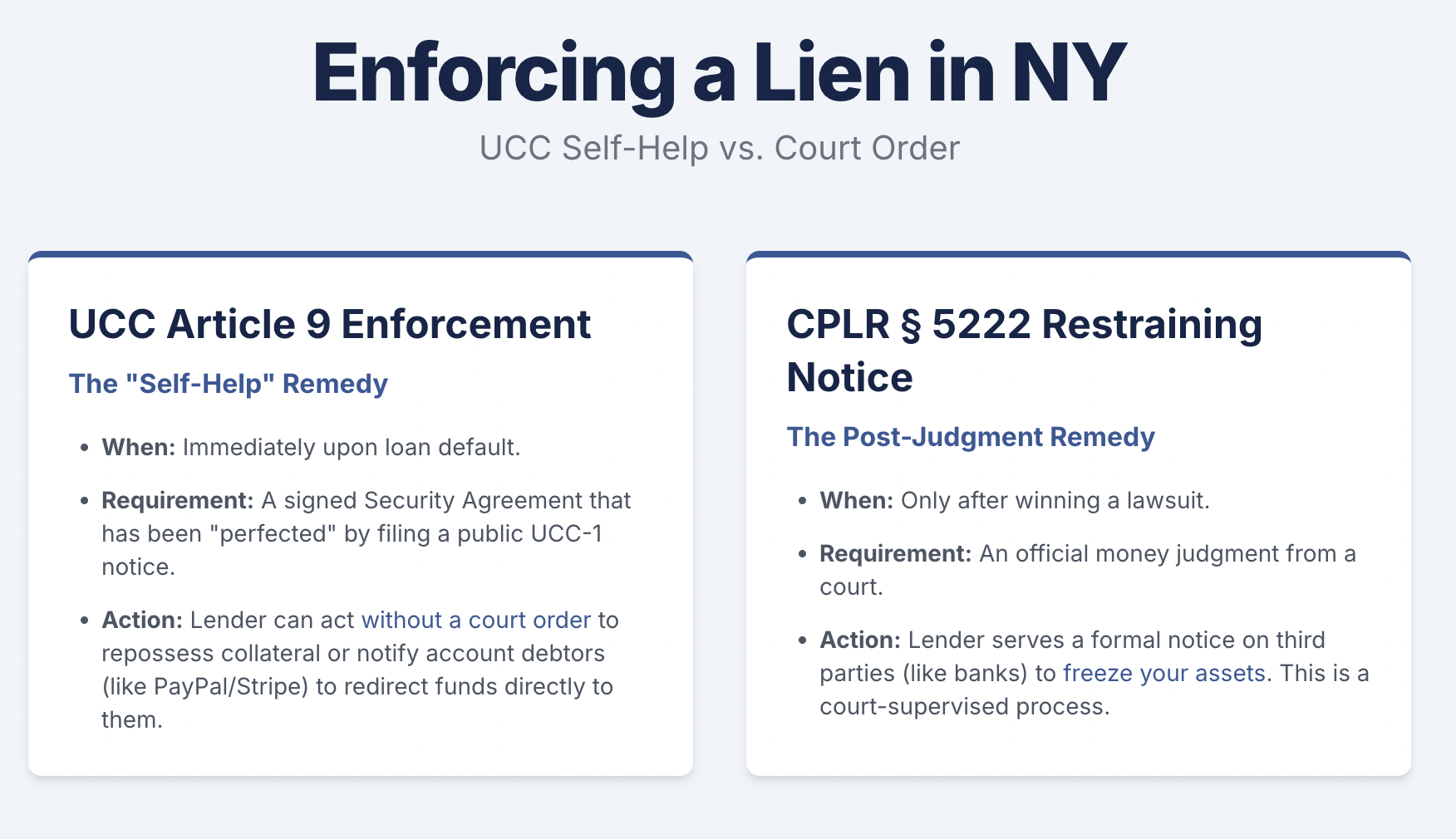

Does enforcing a UCC security interest require a court order?

No. Once default occurs on a secured loan and the security interest is perfected, the secured party may—without judicial process—either notify account debtors to pay it directly (UCC § 9‑607) or take possession of collateral (UCC § 9‑609), provided there’s no breach of the peace.

Can a lender “freeze” PayPal or Stripe balances before winning a judgment?

Yes. A perfected blanket security agreement covering “all accounts” reaches digital‑wallet balances. Upon default, the secured party may notify the platform to redirect payments to itself under UCC § 9‑607, or assert control over proceeds under § 9‑609—no court judgment or restraining notice is required.

What exactly is an “account” under UCC § 9‑102, and why do PayPal/Stripe funds qualify?

UCC § 9‑102(2) defines “account” as a “right to payment of a monetary obligation,” covering amounts owed by any debtor—this expressly includes digital‑wallet balances and platform‑owed funds, even if not a traditional bank deposit.

By contrast, “deposit account” (for Article 9’s separate deposit‑account rules) must be with a bank, but the broader “account” catch‑all reaches non‑bank payment platforms.

What’s the difference between a CPLR § 5222 restraining notice and UCC Article 9 enforcement?

CPLR § 5222 is strictly a post‑judgment remedy: after obtaining a money judgment, the creditor serves a § 5222 restraining notice on “any person … in possession of property in which the debtor has an interest” (e.g., a bank) to freeze funds up to twice the judgment amount.

UCC Article 9 enforcement is a pre‑judgment self‑help tool: once a security interest in “accounts” is perfected by UCC‑1, the secured party may, upon default, notify the account debtor (e.g., PayPal/Stripe) to pay the secured party directly (UCC § 9‑607) or—even repossess collateral—without any court order.

Understanding UCC-1 Filings: Specific Collateral vs. Blanket Liens

When it comes to securing their interests, lenders have two primary options for filing UCC-1 statements:

- Targeted Collateral UCC-1 Filings: Targeted UCC‑1 filings are used for discrete personal‑property collateral—such as a specific machine—or for fixture filings; they do not cover the land or building. They provide lenders with priority secured rights to particular assets, such as machinery or equipment financed by the loan. Real‑property rights are perfected by recording a mortgage or deed of trust, not by a UCC filing.

This type of filing is precise and limited to clearly defined assets.

- Comprehensive Blanket Liens: Also known as "all-asset" liens, these filings offer lenders a broader scope of security. Key features include:

- Coverage extends to a wide range of the borrower's assets

- The collateral box may simply read ‘all assets’ or ‘all personal property,’ which UCC § 9‑504 deems sufficient

- Lenders often prefer this approach due to its expansive coverage

Both types of filings serve to protect the lender's interests, but they differ in the scope of assets they cover. The choice between them often depends on the nature of the transaction and the lender's risk assessment strategy.

Here is a list of New York UCC Forms.

Can Lenders File UCC1 Liens Before a Debtor's Default?

Yes, lenders can and typically do file UCC-1 liens before default. In fact, filing UCC-1 liens before default is a standard practice in commercial lending. Here's a more detailed explanation:

- Timing of UCC-1 Filings: Lenders usually file UCC-1 liens at the time the loan is made or shortly thereafter. This is done as a preventive measure, not in response to a default. The filing establishes the lender's security interest in the specified collateral from the outset of the loan.

- Purpose of Early Filing: By filing early, lenders secure their position as a creditor. This is crucial because:

- It establishes priority over subsequent creditors

- It protects the lender's interests in case of future financial difficulties or bankruptcy of the borrower

- Perfection of Security Interest: Filing a UCC-1 statement "perfects" the security interest. This means the lender's claim on the collateral becomes legally enforceable against third parties.

- Notice to Other Creditors: The UCC-1 filing serves as a public notice to other potential creditors that the lender has a claim on specific assets of the borrower.

- Contractual Requirement: Often, the loan agreement will require the borrower to allow the lender to file a UCC-1 statement as a condition of the loan.

- Duration of the Lien: A financing statement lapses after five years unless a continuation is filed during the six months immediately before that expiration.

It's important to note that while the UCC-1 is filed before default, it doesn't mean the lender can immediately seize assets. The lien gives the lender the right to take action if a default occurs in the future, according to the terms of the loan agreement.

For borrowers, understanding this practice is crucial when entering into secured loans. It's part of the normal process of obtaining business financing and doesn't necessarily indicate distrust or imminent financial problems.

Does Vacating a Judgment Obtained by a Lender Automatically Vacate or Affect a Blanket Lien?

No, vacating a judgment generally does not automatically vacate or affect a previously filed blanket lien, especially if the lien was created by a separate security agreement. Here's why:

- Independent Legal Instruments

- A security agreement and UCC filing create rights separate from any judgment

- The lien exists independently of any court judgment

- The security interest attaches when the agreement is signed and perfected when properly filed

- Timing Considerations

- If the lien was properly filed before the judgment, it remains valid

- The lien's validity stems from the original security agreement, not the judgment

- Only liens that specifically arose from the vacated judgment would be affected

- Required Actions

- To remove a blanket lien, specific steps must be taken:

- Filing a UCC-3 termination statement

- Getting a signed release from the secured party

- Obtaining a specific court order addressing the lien

- Best Practices

- When vacating a judgment, specifically address any liens in the motion

- Seek explicit court orders regarding the status of any liens

- Obtain written confirmation from the lender about the lien's status

- Exception Cases

- If the lien was created solely by the judgment (a judgment lien)

- If the court specifically addresses the lien in its order vacating the judgment

- If the security agreement was found void or fraudulent

To properly remove a blanket lien, it's typically necessary to either:

- Negotiate a release with the lender

- Obtain a specific court order addressing the lien

- Challenge the validity of the underlying security agreement itself

EXAMPLE OF BLANKET SECURITY AGREEMENT

This Blanket Security Agreement ("Agreement") is entered into as of [DATE] by and between [BORROWER NAME], a [STATE] [ENTITY TYPE] with its principal place of business at [ADDRESS] (the "Borrower") and [LENDER NAME], a [STATE] [ENTITY TYPE] with offices at [ADDRESS] (the "Lender").

WHEREAS, the Lender has agreed to provide the Borrower with a [merchant cash advance/commercial loan] in the original principal amount of [LOAN AMOUNT] (the "Loan") pursuant to a [Loan and Security Agreement / Merchant Cash Advance Agreement] of even date herewith between the Borrower and the Lender (the "Loan Agreement"); and

WHEREAS, it is a condition precedent to the Lender making the Loan that the Borrower execute and deliver to the Lender a security agreement granting the Lender a blanket security interest in all assets of the Borrower as collateral security for the Borrower's obligations under the Loan Agreement.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

- Security Interest. As collateral security for the prompt and complete payment and performance when due of all the Obligations (as defined in the Loan Agreement), the Borrower hereby grants to the Lender a continuing security interest in and lien upon the following personal property of the Borrower, wherever located, whether now owned or hereafter acquired (collectively, the "Collateral"): (a) all accounts, chattel paper, deposit accounts, documents, equipment, general intangibles, instruments, inventory, and investment property, as those terms are defined in Article 9 of the Uniform Commercial Code as in effect in [STATE]; (b) all goods not otherwise described above, including without limitation all machinery, fixtures (to the extent not subject to a real estate mortgage), vehicles, and furniture; (c) all commercial tort claims specifically described in Schedule A attached hereto; (d) all intellectual property rights, including without limitation all patents, trademarks, trade names, copyrights, and trade secrets, together with all goodwill associated therewith, and all applications, registrations, licenses, and agreements relating thereto; (e) all books, records, and data relating to the Borrower's business, whether in tangible or electronic form; (f) all supporting obligations, letter-of-credit rights, and all guarantees, endorsements, and indemnifications on, or of, any of the foregoing; and (g) all proceeds and products of any and all of the foregoing, including without limitation all insurance proceeds, and all accessions to, substitutions and replacements for, and profits and products of, each of the foregoing.

- Covenants. The Borrower covenants and agrees that it shall: (a) defend the Collateral against all claims and demands of all persons at any time claiming any interest therein; (b) keep the Collateral free and clear of all liens, security interests and encumbrances (except those created hereby); (c) maintain insurance on the Collateral; (d) pay promptly when due all taxes, assessments, and governmental charges on the Collateral; and (e) execute and deliver to the Lender such supplemental documentation as the Lender may reasonably request to further evidence, secure and perfect its security interests granted herein.

- Events of Default. The occurrence of an Event of Default under the Loan Agreement shall constitute an event of default hereunder and shall entitle the Lender to exercise all rights and remedies available to it under this Agreement, the Loan Agreement, the Uniform Commercial Code and other applicable law.

- Remedies Upon Default. Upon the occurrence of any event of default, the Lender shall have the right to declare all Obligations immediately due and payable and may proceed to enforce payment of same and exercise any and all of the rights and remedies available to it under the Uniform Commercial Code and other applicable law.

- Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of [STATE].

IN WITNESS WHEREOF, the Borrower has executed this Blanket Security Agreement as of the date first above written.

[BORROWER NAME]

By:_____________________ Name: Title:

This is just an example and must be tailored to the specific transaction and parties involved. Key elements include:

- Granting of a blanket security interest in all assets of the borrower

- Representations and warranties by the borrower about its ownership of the collateral and authorization to enter into the agreement

- Covenants by the borrower to maintain and protect the collateral

- Remedies available to the lender upon default

- Governing law provision

A blanket security agreement of this nature would typically be entered into in connection with and cross-reference a related loan agreement or merchant cash advance agreement between the parties. Consultation with legal counsel is advised in preparing and negotiating these types of agreements.

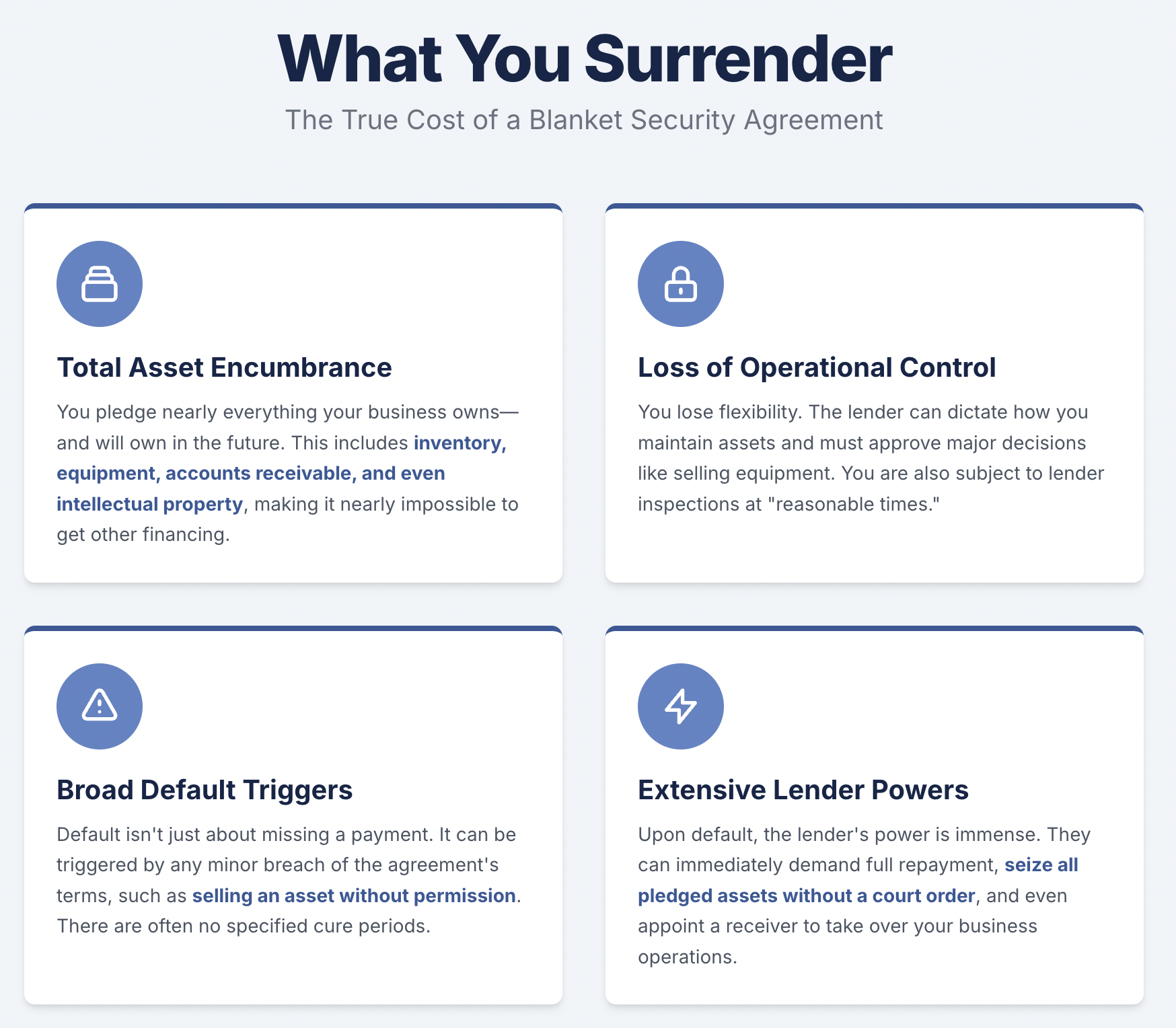

The Pitfalls of a Blanket Security Agreement: What the Debtor May Surrender

Key features and what the debtor gives up, knowingly or unknowingly:

- Broad collateral: The debtor pledged essentially all business personal property—accounts, equipment, inventory, intellectual property, and their proceeds—so few business assets remain free to use as collateral for another lender.

- Broad lender rights: Upon default, the lender can usually accelerate the loan and use UCC/self‑help or court remedies allowed in the agreement.

- Ongoing obligations: The debtor must defend the collateral against all claims, keep it free of liens and encumbrances, maintain insurance, pay taxes and assessments, and execute additional documentation as requested by the lender. These obligations can be burdensome and costly.

- Limited debtor flexibility: The debtor often needs lender consent to sell or encumber major assets outside the ordinary course of business.

- Cross-default provisions: The occurrence of an event of default under the related loan or merchant cash advance agreement also constitutes a default under the blanket security agreement, expanding the lender's remedies.

- Potential for lender overreach: The broad nature of the security interest and remedies granted to the lender may enable the lender to exert significant control over the debtor's business and assets, even in situations where it may not be warranted.

- Difficulty obtaining additional financing: With all assets pledged to the lender, the debtor may struggle to secure additional financing from other sources, as they would likely require subordinate liens.

- Heightened risk of losing essential assets: If the debtor defaults, they risk losing critical assets essential to their business operations, as the lender can seize and sell the collateral to satisfy the debt.

- Lack of negotiating power: Many borrowers may feel compelled to accept the terms of a blanket security agreement due to their need for financing, without fully understanding the potential consequences of granting such broad rights to the lender.

- Strains on the debtor-creditor relationship: Enforcement of a broad lien after default can make the relationship adversarial.

What the Debtor Surrenders in a Blanket Security Agreement (Stated Another Way)

- Total Asset Encumbrance

- The debtor usually pledges too many assets

- Includes intangible assets like intellectual property and accounts receivable that the business may not even realize have been pledged

- Even extends to proceeds from insurance claims and future replacements of current assets

- Operational Control Limitations

- Cannot sell, lease, or dispose of any business assets without lender approval

- Must maintain all assets according to lender's standards

- Must allow lender inspections at "reasonable times" (term is vague and favors lender)

- Must notify lender of any business structure or name changes, limiting operational flexibility

- Default Trigger Breadth

- Default can be triggered not just by missing payments, but by any breach of warranties or covenants

- Even attempting to sell or encumber assets without permission constitutes default

- Financial difficulty short of bankruptcy (like assignment for creditors) triggers default

- Once in default, entire obligation becomes immediately due

- Extensive Post-Default Powers

- Lender can seize all pledged assets upon default

- Can appoint a receiver to take over business operations

- Has right to sell business assets without further approval

- Can exercise "any other rights" - an extremely broad catch-all provision

- Personal Exposure

- Warranties about asset ownership and absence of liens create personal liability risk

- Requirement to "defend" collateral creates potential litigation obligations

- Insurance requirements create additional ongoing costs

- Future Asset Capture

- Security interest automatically attaches to newly acquired assets

- Includes future accounts receivable and inventory

- Captures proceeds from sale of any assets

- Extends to any replacement property

- Record-Keeping Obligations

- Must maintain books and records about all collateral

- These records themselves become collateral

- Creates ongoing administrative burden

- Lender has right to inspect these records

- Competitive Disadvantage

- Cannot obtain additional financing using same collateral

- Limits ability to enter strategic partnerships requiring asset commitments

- Restricts ability to sell or spin off parts of business

- May need to disclose agreement to potential business partners

- Remedy Imbalance

- No cure periods specified for defaults

- No specified limitations on lender's remedy rights

- All remedies are cumulative, meaning lender can pursue multiple at once

- Debtor has effectively waived many standard commercial protections

- Long-Term Impact

- Agreement binds successors and assigns

- Could affect future sale or transfer of business

- May impact bankruptcy restructuring options

- Creates ongoing compliance obligations that survive original loan term

This agreement essentially gives the lender significant control over the debtor's business operations and assets, often beyond what might be necessary to secure the loan. Many debtors sign such agreements without fully understanding how comprehensively they have encumbered their business and restricted their future options.

Types of Security Agreements

1. Accounts Receivable Security Agreement

- What it covers: Right to payment from customers

- Example: "All accounts, payment intangibles, and proceeds from sales of goods or services"

- Common uses: Factoring, working capital lines

2. Agricultural Security Agreement

- What it covers: Crops, livestock, farm equipment, farm products

- Example: "All growing crops on described real estate, all harvested grain, all farm equipment"

- Special rules: May involve Food Security Act compliance

3. Blanket Security Agreement

- What it covers: Substantially all business assets across multiple categories

- Example: "All inventory, equipment, accounts, general intangibles, and other personal property of every kind"

- Key feature: Comprehensive coverage but must list specific asset categories

4. Consignment Agreement

- What it covers: Goods delivered for sale by another party

- Example: "All widgets delivered to Retailer for sale, remaining property of Consignor"

- UCC note: Must comply with Article 9 to maintain priority

5. Cross-Collateralization Agreement

- What it covers: Links collateral across multiple loans

- Example: "Collateral for this loan also secures all other present and future obligations to Lender"

- Risk: Can tie up assets across multiple transactions

6. Deposit Account Control Agreement

- What it covers: Bank account funds

- Example: "All funds in Operating Account #789 at First National Bank"

- Key requirement: Usually requires tri-party control agreement with bank

7. Intellectual Property Security Agreement

- What it covers: Patents, trademarks, copyrights, trade secrets

- Example: "All patents listed on Schedule A, all trademarks and associated goodwill, and all licensing revenues"

- Special note: Often requires additional IP-specific filings

8. Inventory-Only Security Agreement

- What it covers: Current and after-acquired inventory

- Example: "All inventory held for sale or lease, including raw materials, work-in-process, and finished goods"

- Common users: Inventory lenders, floor plan financers

9. Investment Property Security Agreement

- What it covers: Stocks, bonds, securities accounts

- Example: "1,000 shares of XYZ Corp common stock held in Account #456 at Broker"

- Perfection: Often requires control agreements with brokers

10. Purchase Money Security Agreement (PMSA)

- What it covers: Specific items being financed by the loan

- Example: "Security interest in one 2025 John Deere 8R Tractor, Serial

#123456, being purchased with these loan proceeds" - Key benefit: Can achieve priority over existing blanket liens if properly perfected

11. Specific Collateral Security Agreement

- What it covers: Particular identified assets only

- Example: "Security interest in debtor's accounts receivable from ABC Corp. under Contract #789 dated 1/1/25"

- Common uses: Equipment loans, vehicle financing, specific invoice factoring

Key Factors in Choosing Agreement Type:

- Loan purpose: Purchase money vs. working capital vs. general business loan

- Collateral availability: What assets are unencumbered

- Priority needs: Whether priority over existing liens is required

- Administrative burden: Specific collateral requires more monitoring

- Borrower flexibility: Blanket agreements restrict future financing options

TYPES OF UCC Filings: Key Concepts and Procedures

- UCC-1 Filings: Securing Lender Interests UCC-1 statements offer lenders a powerful tool to secure their loans using the borrower's personal property as collateral. Filing a UCC‑1 usually perfects the security interest in most business assets. Certain collateral (like deposit accounts or investment accounts) instead requires control or possession. Perfection establishes the lender’s place in line—usually ahead of later filers and unsecured creditors, subject to special rules (e.g., purchase‑money or statutory liens). By utilizing UCC-1 filings, lenders can significantly reduce their risk in lending transactions.

- The Versatile UCC-3 Form: When modifications to the original UCC-1 are necessary, lenders turn to the UCC-3 form. A UCC‑3 is used to amend collateral information, assign the lien to another party, file a continuation, or file a termination.

- Removing UCC Filings: Options for Businesses After fully repaying a loan, businesses have avenues to remove the associated UCC filing. After payoff, ask the lender to file a UCC‑3 termination. If the lender fails to do so within the required time, the debtor may be authorized under the UCC to file the termination itself. Procedures vary by state.

- Extending UCC-1 Validity: A continuation filed in the last six months before lapse extends the financing statement for another five years from its scheduled lapse date.. By filing a continuation statement, lenders can typically add five years to the filing's validity from the date of continuation, ensuring their security interest remains protected.

These elements form the backbone of the UCC filing system, providing a structured yet flexible framework for managing secured transactions in the business world. Understanding these concepts is crucial for both lenders and borrowers navigating the complexities of commercial lending.

Quick Guide: Filing UCC Statements in New York

New York still uses its own 2002 UCC forms (not the 2011/2023 national versions). Download them from the NY Department of State.

Forms you may need

UCC1 – Initial financing statement

UCC1 Addendum – Extra collateral info

UCC1AP – Additional party (if more debtors/secured parties)

Co‑op Addendum – For cooperative apartment filings

Key New York quirks

Must list the debtor’s type of organization and jurisdiction.

Individual debtor names use “First / Middle / Last” format.

Some checkboxes/fields appear in different places than the national forms—read carefully.

Fees (subject to change)

Paper or fax: $40

Online (e‑file/XML): $20

Where to file

Real‑estate–related collateral (fixture filings/co‑ops): County Clerk where the property is located.

All other filings: New York Department of State.

Because New York asks for extra information, review the instructions or consult counsel before submitting.

Legal Disclaimer: The information provided in this article is for general informational purposes only and does not constitute legal advice. Every situation is unique, and readers are encouraged to consult with a qualified legal professional for advice specific to their circumstances.

Blanket Security Agreement FAQs: Protecting Your Business Assets

What is a blanket security agreement? A contract granting lenders a security interest in ALL business assets (inventory, equipment, accounts receivable, intellectual property) as collateral, not just specific items.

Can a lender seize my assets without going to court? Yes. Under UCC § 9-607 and § 9-609, lenders can notify payment platforms to redirect funds or repossess collateral upon default without judicial process, as long as there's no breach of peace.

What exactly am I giving up when I sign a blanket security agreement? You surrender: ability to sell/dispose of assets without permission, right to additional financing, operational control, and risk losing ALL business assets if you default on even one payment.

How do I properly file a UCC-1 financing statement? File with Secretary of State using exact debtor legal name, describe collateral, pay fees ($20-40), and ensure accuracy - even minor name errors can invalidate the entire filing.

What's the difference between a security agreement and a UCC-1 filing? Security agreement = private contract creating the lien (must be specific). UCC-1 = public notice filing that can use "all assets" description under UCC § 9-504.

Can PayPal or Stripe balances be frozen by lenders? Yes. Digital wallets qualify as "accounts" under UCC § 9-102(2), allowing perfected secured parties to redirect payments without court orders upon default.

How long do UCC liens last and how can I remove them? 5 years initially, renewable indefinitely. Remove by: getting lender to file UCC-3 termination, paying off debt, or filing yourself if lender fails to terminate within required timeframe.

What happens if I default on a loan with a blanket lien? Lender can immediately: accelerate entire debt due, seize all pledged assets, sell assets without your approval, appoint receiver to run your business, exercise "any other rights."

How do blanket liens affect my ability to get future financing? Severely restricts options - new lenders won't accept already-pledged collateral, must take subordinate position, making approval unlikely and terms unfavorable.

What are the different types of UCC filings and when do I use each? UCC-1 (initial filing), UCC-3 (amendments/terminations/continuations/assignments). File UCC-1 for new loans, UCC-3 to modify/continue/terminate existing filings.

![]()