Standing Requirements in Student Loan Litigation

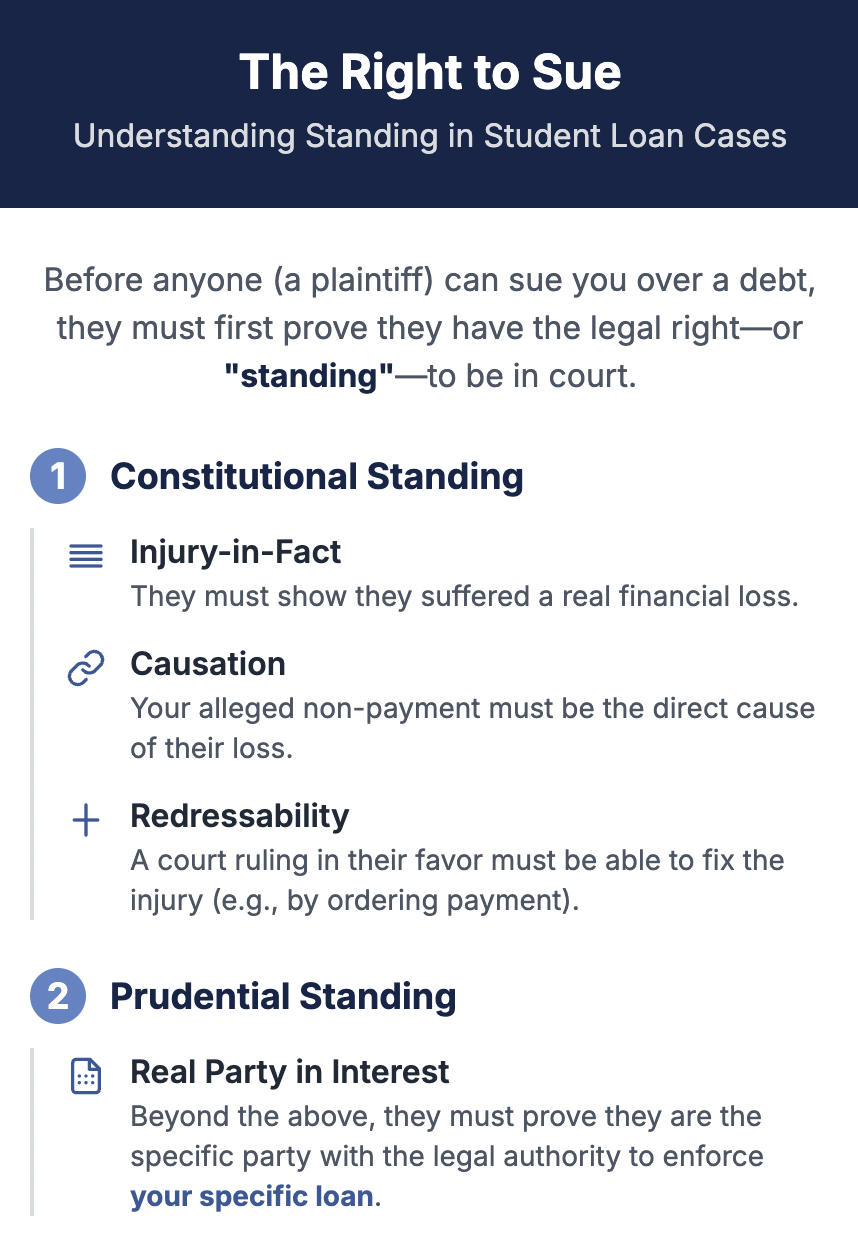

The doctrine of standing serves as a jurisdictional prerequisite that every plaintiff must satisfy before proceeding with litigation. In the context of student loan collection actions, this fundamental requirement often presents substantive challenges for plaintiffs, particularly debt buyers and assignees.

Constitutional and Prudential Standing Requirements

To establish Article III standing, a plaintiff must demonstrate:

- Injury in fact – a concrete and particularized economic harm

- Causation – a direct causal connection between the defendant's conduct and the alleged injury

- Redressability – a likelihood that judicial intervention will remedy the claimed injury

Beyond these constitutional minimums, student loan plaintiffs must also satisfy prudential standing requirements by proving they are the real party in interest with legal authority to enforce the obligation.

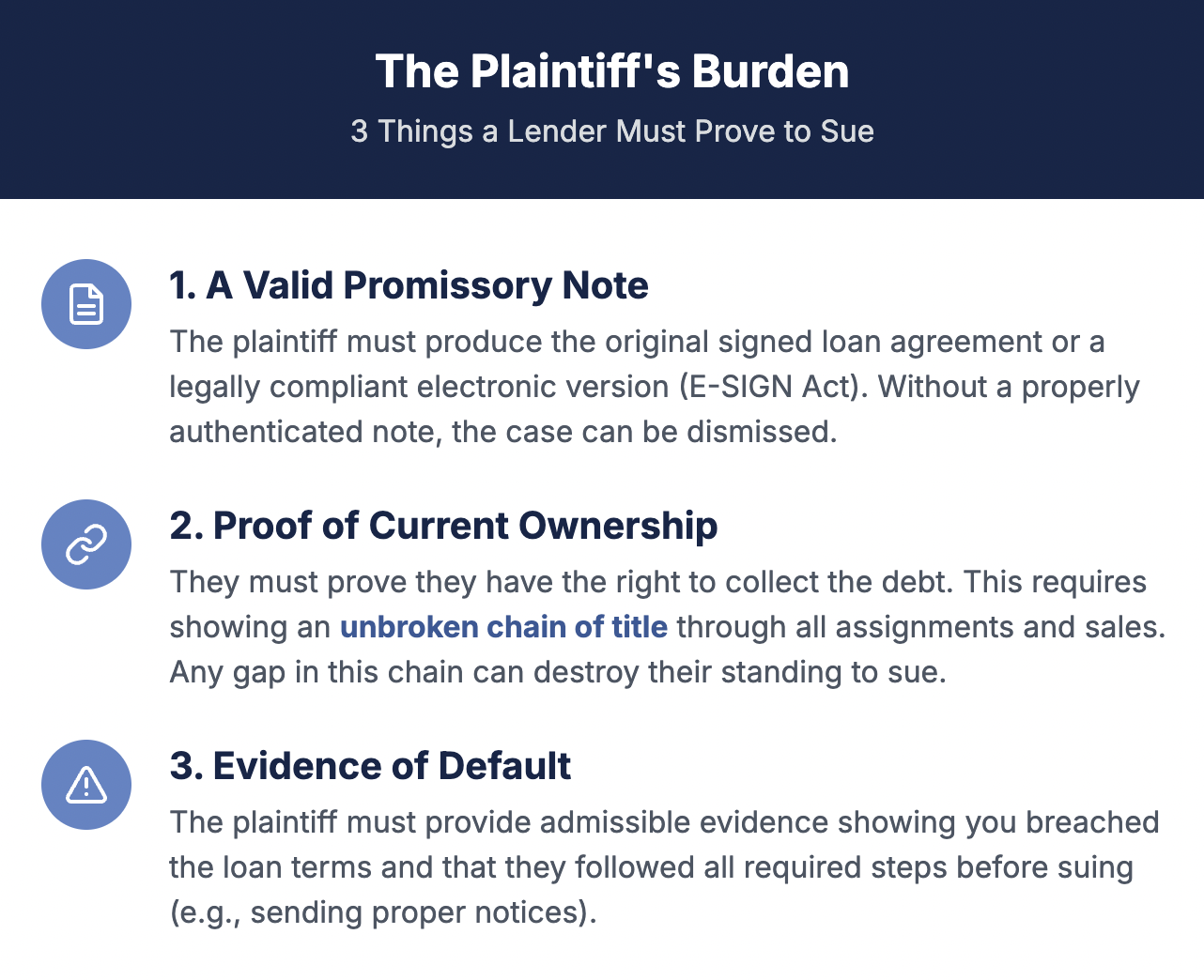

Elements of a Prima Facie Case in Student Loan Litigation

To establish standing and state a viable cause of action, plaintiffs must prove three essential elements:

1. Execution of a Valid Promissory Note

The plaintiff must produce the original promissory note or its legal equivalent, demonstrating the defendant's obligation. In the era of electronic lending, this requirement has become increasingly complex. Electronic promissory notes must comply with E-SIGN Act requirements and remain retrievable throughout the life of the loan. Courts have dismissed cases where plaintiffs cannot produce properly authenticated notes, whether due to inadequate electronic storage systems or lost physical documents.

2. Proof of Current Ownership or Holder Status

Establishing standing requires clear documentation of the plaintiff's current right to enforce the note. This becomes particularly challenging in cases involving multiple assignments or securitization. Plaintiffs must demonstrate an unbroken chain of title through properly executed assignments, endorsements, or other transfer documents. Any gap in the chain of ownership can be fatal to standing.

3. Evidence of Default

The plaintiff must present admissible evidence establishing that:

- The defendant breached the terms of the promissory note

- All conditions precedent to acceleration have been satisfied

- Proper notice was provided as required by the loan documents and applicable law

Strategic Considerations for Defense Counsel

Standing challenges should be raised at the earliest opportunity through motions to dismiss or motions for summary judgment. Because standing is a threshold jurisdictional issue, courts must address these challenges before reaching the merits of the underlying debt claim. Successful standing challenges can result in dismissal without prejudice, though defendants should be mindful of potential refiling within applicable limitations periods.

For practitioners defending student loan collection actions, thorough discovery regarding loan ownership and documentation is essential. Requests should focus on obtaining all assignments, pooling and servicing agreements, and powers of attorney that purport to establish the plaintiff's authority to enforce the obligation.

Critical Precedent: How Acceleration Letters Can Bar Collection Efforts

The complexity of defending against student loan collection lawsuits is further illustrated by recent case law that highlights another crucial defense: the interplay between debt acceleration and statutes of limitations. The following case demonstrates how collection activities by the original lender can inadvertently bar later collection efforts by debt buyers, providing defendants with a powerful time-based defense.

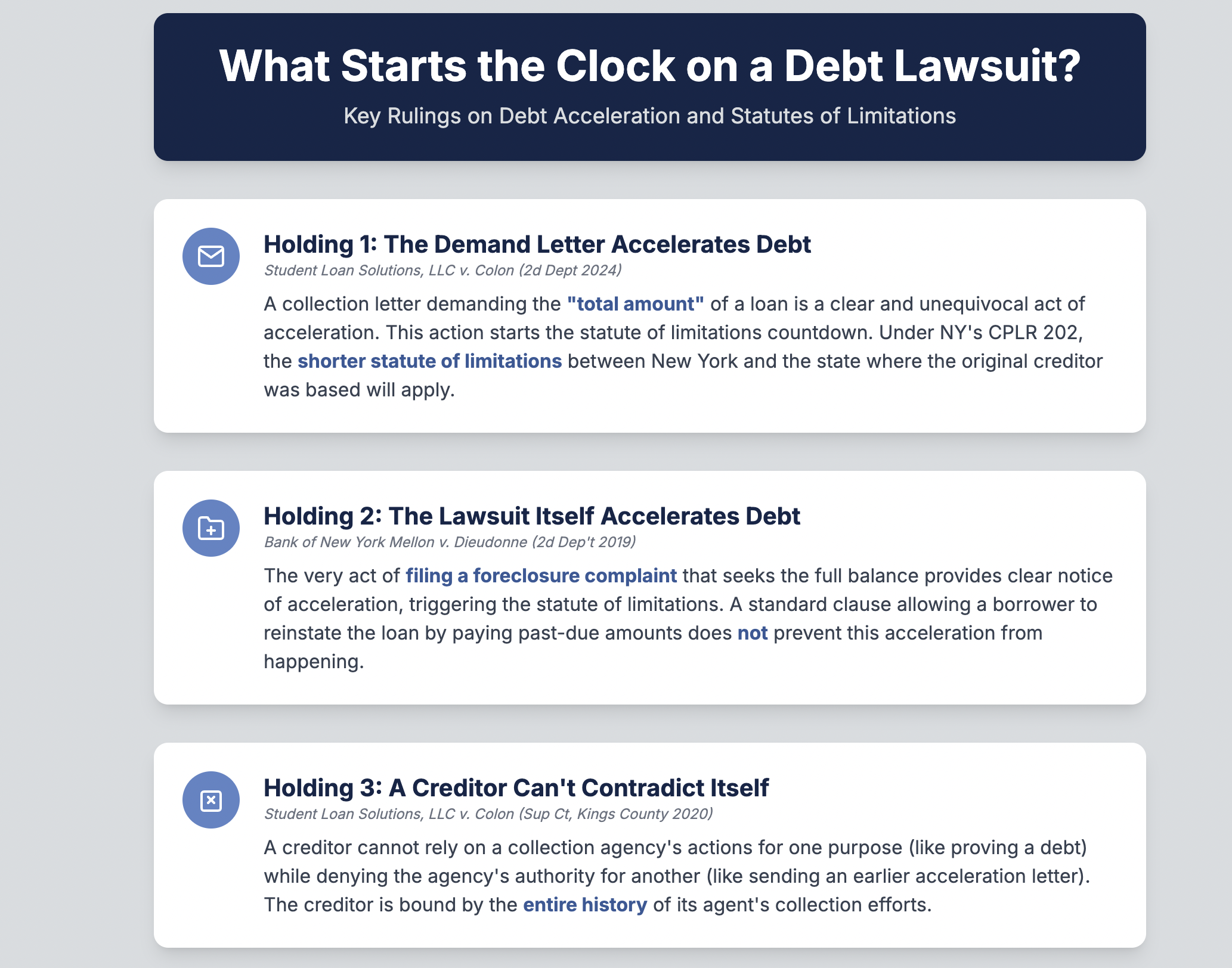

Private Student Loan Debt Accelerated by Collection Letter Triggers Three-Year North Carolina Statute of Limitations Under CPLR 202

A debt collection letter demanding payment of the "total amount" of a delinquent private student loan and requesting "the balance in full" constituted clear and unequivocal acceleration of the entire debt, triggering the statute of limitations. The borrowers entered into a $38,000 private loan agreement with Bank of America in 2007, which was later sold to a debt buyer in 2017. When Bank of America's collection agency sent a letter in 2013 demanding immediate payment of $43,374.19 as the "total amount" owed, this accelerated the entire debt. Under CPLR 202, since Bank of America was headquartered in North Carolina where the economic injury occurred, North Carolina's three-year statute of limitations for breach of contract applied rather than New York's six-year period, making the 2019 lawsuit time-barred.

Key Legal Principles:

- A collection letter demanding payment of the "total amount" of a delinquent debt and requesting "the balance in full" constitutes clear and unequivocal acceleration of an installment loan, even without using the word "acceleration."

- Under CPLR 202, when a nonresident sues on a cause of action accruing outside New York, the shorter of either New York's or the other jurisdiction's statute of limitations applies.

- For breach of contract claims involving purely economic injury, the cause of action accrues where the plaintiff resides and sustains the economic impact, not where the defendant is located.

Conclusion: The main takeaway is that debt buyers purchasing out-of-state loans must carefully analyze both when acceleration occurred and which state's statute of limitations applies under CPLR 202, as the shorter limitations period will control and may bar collection efforts.

Citation: Student Loan Solutions, LLC v. Colon, 2024 NY Slip Op 05125 (2d Dept 2024).

Collection Agency's Letter Demanding "Total Amount" of Student Loan Constitutes Valid Acceleration Triggering Statute of Limitations

A debt buyer who purchased a private student loan from Bank of America could not defeat statute of limitations by arguing that the collection agency lacked authority to accelerate the debt when the same agency's letters were being used to prove other aspects of the case. The borrowers obtained a student loan from Bank of America, and in 2013, Williams & Fudge, Inc. sent a letter stating they were retained "to collect the total amount from you in connection with a delinquent educational debt." When the debt buyer filed suit in 2019, it attempted to rely on a different 2019 letter from the same collection agency while simultaneously arguing the agency lacked authority to accelerate in 2013. The court rejected this contradictory position, finding the 2013 letter's language demanding the "total amount" was clear and unequivocal acceleration. Under CPLR 202, the action was time-barred whether California's four-year or South Carolina's three-year statute of limitations applied.

Key Legal Principles:

- A creditor cannot selectively recognize a collection agency's authority by using one letter from the agency as evidence while denying that same agency had authority to send other letters.

- Language stating a collection agency was retained "to collect the total amount" constitutes clear and unequivocal acceleration of an installment loan, distinguishing it from conditional language using "may" or "if."

- Under CPLR 202, when determining where a cause of action accrued for statute of limitations purposes, courts look to where the default in payments and direction to accelerate occurred, not necessarily where the current plaintiff is located.

Conclusion: The main takeaway is that debt buyers purchasing loans must accept the full history of collection efforts by their predecessors' agents, including acceleration notices that may have already triggered the statute of limitations before the purchase.

Citation: Student Loan Solutions, LLC v. Colon, 2020 NY Slip Op 51465(U) (Sup Ct, Kings County 2020).

Clear and Unequivocal Notice Required to Accelerate Mortgage; Reinstatement Rights Do Not Toll Limitations Period

A mortgagee filed a 2016 foreclosure action on a mortgage previously accelerated by filing a foreclosure complaint in June 2010. The borrower moved to dismiss as time-barred, and the trial court granted the motion. On appeal, the mortgagee argued that the mortgage's paragraph 19 reinstatement provision—allowing borrowers to de-accelerate under certain conditions—prevented valid acceleration until those rights expired. The Appellate Division affirmed dismissal, holding that filing the 2010 foreclosure complaint provided clear and unequivocal notice of acceleration as required by law. The court rejected the mortgagee's novel argument that the reinstatement provision was a condition precedent to acceleration, finding that paragraph 22 listed all acceleration conditions and did not reference the reinstatement provision.

Key Legal Principles:

- A lender must provide clear and unequivocal notice of its decision to accelerate a mortgage loan, which can be satisfied by filing a foreclosure complaint.

- Mortgage reinstatement provisions that allow borrowers to de-accelerate debt are not conditions precedent to acceleration and do not prevent the statute of limitations from running.

- Once validly accelerated, the entire mortgage debt becomes due and the six-year statute of limitations begins running on the full amount, regardless of any subsequent reinstatement rights.

Conclusion: The main takeaway is that lenders can provide valid notice of acceleration by filing a foreclosure action, and standard reinstatement provisions do not toll the limitations period, leaving lenders who delay successive actions vulnerable to time-bar defenses.

Citation: Bank of New York Mellon v. Dieudonne, 171 A.D.3d 34, 96 N.Y.S.3d 354 (2d Dep't 2019).

Conclusion

The intersection of standing requirements, practical defense strategies, and evolving case law demonstrates that successfully challenging a student loan collection lawsuit requires both a thorough understanding of legal principles and careful attention to case-specific details.

These cases underscore a critical point: debt buyers and collection agencies must navigate a complex web of legal requirements, and their failure to do so can provide borrowers with strong defenses. Whether it's inadequate documentation of ownership, procedural failures by attorneys, disputes over loan classification, or acceleration letters that inadvertently trigger shorter statutes of limitations, each potential weakness in the plaintiff's case represents an opportunity for defense.

If you are being sued over a defaulted student loan, you should explore your legal options immediately before taking any action. The complexity of these cases underscores the importance of seeking qualified legal counsel who can evaluate the specific circumstances of your situation, identify all available defenses, and develop a comprehensive strategy to challenge the collection efforts. If you have any questions or comments, please feel free to contact us.

[1] Federal Deposit Insurance Company v. McCrary, 977 F.2d 192, 194 n. 5 (5th Cir.1992); see also U.S. v. Bielinski, 2012 WL 1802303, at *2 (N.D.N.Y.,2012)