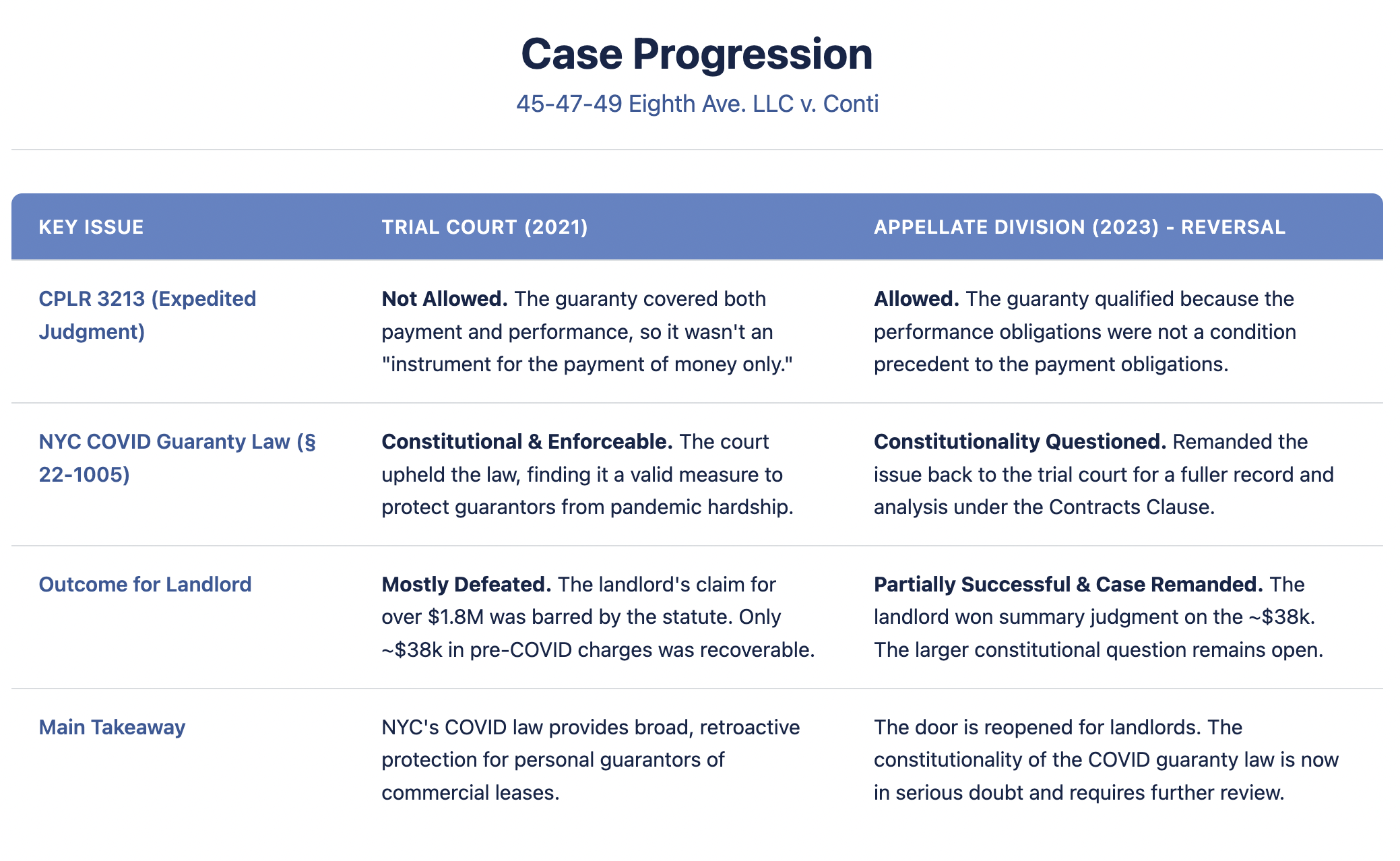

The Appellate Division, First Department, reversed the trial court and held that a commercial lease personal guaranty covering both payment and performance obligations was susceptible to summary judgment in lieu of complaint under CPLR § 3213, where performance was not a condition precedent to payment. The court granted partial summary judgment to the landlord for $37,875.81 in undisputed amounts (pre-COVID water/sewer charges and brokerage commission repayment) that fell outside the protection period of NYC Administrative Code § 22-1005. However, in light of a recent federal decision finding § 22-1005 unconstitutional under the Contracts Clause, the Appellate Division remanded the constitutional question for the trial court to apply the Contracts Clause test and develop a fuller record, reversing the dismissal of the landlord's remaining claims pending resolution of the constitutional issue.

Key Legal Principles:

- CPLR § 3213 Availability for Mixed Guaranties: A personal guaranty covering both payment and performance obligations qualifies as an instrument susceptible to summary judgment in lieu of complaint under CPLR § 3213 when performance is not a condition precedent to payment, contrary to the general rule that guaranties of both payment and performance are excluded from CPLR § 3213 treatment.

- Summary Judgment Requirements for Guaranty Enforcement: To obtain summary judgment on a personal guaranty, the plaintiff must establish three elements: (1) the existence of the guaranty, (2) the underlying debt, and (3) the guarantor's failure to perform under the guaranty. Claims falling outside the temporal scope of protective statutes remain enforceable.

- Constitutional Review and Remand for Record Development: When a significant constitutional question regarding a statute's validity under the Contracts Clause arises—particularly following federal court decisions finding similar provisions unconstitutional—appellate courts may remand to the trial court for further development of the factual record necessary to apply the appropriate constitutional test, with notice to governmental entities to intervene in defense of the statute's constitutionality.

Conclusion:

The Appellate Division's reversal significantly altered the procedural posture and scope of the landlord's claims, establishing that the guaranty was properly subject to expedited CPLR § 3213 treatment and that the constitutional validity of NYC's COVID-19 guaranty protection law required further judicial scrutiny. The main takeaway is that while guaranties covering multiple types of obligations may still qualify for summary judgment in lieu of complaint, the enforceability of such guaranties against pandemic-era defaults remains subject to unresolved constitutional questions that require comprehensive factual development and governmental participation to resolve.

Citation:

45-47-49 Eighth Ave. LLC v. Conti, 220 A.D.3d 473, 199 N.Y.S.3d 20 (1st Dep't 2023)

On appeal from the trial court's decision, the Appellate Division reversed key portions of the lower court's ruling and remanded for constitutional analysis, as detailed above. The trial court's original decision had reached the following conclusions:

Commercial Lease Personal Guarantee Unenforceable Under COVID-19 Protection Statute

A landlord's attempt to enforce a personal guarantee against a restaurant tenant's principal for COVID-19 era defaults was largely barred by NYC Administrative Code § 22-1005, which protects individual guarantors from liability for rent and related obligations when defaults occurred between March 7, 2020 and June 30, 2021. The court found that the statute applied retroactively to guarantees "relating to" commercial leases, even those executed as separate documents, and did not violate the Contracts Clause. Additionally, the guarantee—which covered both payment and performance obligations—did not qualify as an "instrument for the payment of money only," making summary judgment under CPLR 3213 unavailable. Of the $1,827,750.20 sought, only $37,875.81 remained enforceable (pre-COVID water/sewer charges and brokerage commission repayment).

Key Legal Principles:

- CPLR § 3213 Instrument Requirements: A personal guarantee that encompasses both monetary obligations and non-monetary performance duties (such as maintaining premises, keeping the business open continuously, and pest control) does not constitute an "instrument for the payment of money only," thereby precluding summary judgment in lieu of complaint under CPLR § 3213.

- COVID-19 Impossibility and Frustration Defenses: Executive orders requiring restaurants to cease on-premises dining and limiting operations to takeout/delivery services do not render lease payment obligations impossible or frustrate the lease's purpose when the premises remain usable, the restrictions are temporary, and the tenant can continue operating in a modified capacity, even if less profitably.

- NYC Administrative Code § 22-1005 Scope and Retroactivity: Section 22-1005 bars enforcement of personal guarantees against natural persons for rent, utilities, taxes, and maintenance fees when defaults occurred during the COVID-19 covered period. The statute applies to guarantee provisions both contained within and "relating to" commercial leases (including separate guarantee agreements integrated into the lease), applies retroactively based on legislative intent evidenced by the statute's backward-looking effective dates, and withstands Contracts Clause scrutiny as an appropriate measure advancing the legitimate public purpose of limiting economic damage caused by COVID-19.

Conclusion:

This decision establishes that NYC's COVID-19 tenant protection statute substantially limits landlords' ability to pursue personal guarantors for pandemic-era defaults in commercial lease contexts, even when guarantees were executed years before the pandemic and as separate documents. The main takeaway is that § 22-1005 protects individual guarantors from liability for most rent-related obligations when defaults occurred during the covered COVID period, and courts will interpret the statute broadly to effectuate its remedial purpose of mitigating pandemic-related economic harm, while still allowing landlords to pursue guarantors for pre-COVID defaults and certain non-covered obligations like brokerage commission repayments.

Citation:

45-47-49 Eighth Ave. LLC v. Conti, 2021 NY Slip Op 50691(U) (Sup. Ct., N.Y. County 2021)